How to Check Your Medical Insurance in Saudi Arabia (KSA) – Quick & Easy Guide: The medical insurance system in Saudi Arabia is being run mostly with the help of the Council of Cooperative Health Insurance. Who bears the responsibility of all insurance policies rules and regulations.

Also Read: How To Check Medical Insurance Status With Emirates ID

The importance of health insurance in Saudi Arabia is very important. Because this country strictly follows the laws and regulations to ensure health safety and welfare for each of its employees and public.

Why checking medical insurance is important because health insurance is an important requirement in Saudi Arabia. Below is some information that will let you know why health insurance is necessary in Saudi Arabia.

List of all Health Insurance Companies in Saudi Arabia

Here are some health insurance companies of Saudi Arabia in which you can get insurance from any company.

- Bupa Arabia for Cooperative Insurance.

- Tawuniya (The Company for Cooperative Insurance).

- Medgulf (Mediterranean and Gulf Cooperative Insurance and Reinsurance Company).

- Allianz Saudi Fransi Cooperative Insurance.

- AXA Cooperative Insurance Company.

- Saudi Enaya Cooperative Insurance Company.

- Walaa Cooperative Insurance Company.

- Malath Cooperative Insurance & Reinsurance Co.

- Al Rajhi Takaful.

- Al-Etihad Cooperative Insurance Co.

- Arabia Insurance Cooperative Company (AICC).

- Gulf Union Al Ahlia Cooperative Insurance Company.

- Chubb Arabia Cooperative Insurance Company.

- Al Sagr Cooperative Insurance Co.

- Solidarity Saudi Takaful.

- Salama Cooperative Insurance Co.

- Arabian Shield Cooperative Insurance Co.

- GIG (Gulf Insurance Group) Saudi Arabia.

- United Cooperative Assurance (UCA).

- Weqaya Takaful Insurance and Reinsurance Co.

Why is it important to know about medical insurance?

Your access to health services.

It is very important to check your insurance because it lets you know whether your health is continuous and whether you are covered by it in hospitals, clinics, and other medical facilities. You can monitor your health.

Payment security

If you people get your health insurance in Saudi Arabia, then it is a good idea, it reduces the health burden of you people to a great extent.

Checking health insurance coverage?

A health insurance coverage check is done to tell you which medical services your policy covers and which ones will cost you more.

It is very important to ensure the coverage before medical treatment because if tomorrow you may face any treatment problems and if you have your health insurance or if you are full at this time can help.

It is very important to check your health insurance with the e-medical facility it helps you whether the hospital or clinic you are affiliated with is insured or not so it is very important to check your health insurance.

If you want to avoid being fined, then you have to follow the following rules.

How to Check Your Medical Insurance in Saudi Arabia (KSA) – Quick & Easy Guide: Following the rules is the most important thing to avoid being fined. First of all, you should follow the rules and follow the tips given by them. After that, there are traffic and commercial rules, public places such as markets, shopping malls and many other places where people have to abide by public places.

You can also avoid fines by making payments and registration on time. But if you people delay the payment and registration of the car etc., then you may have to pay the penalty. The things you can be fined for are vehicle registration, business license, or health insurance etc. You may have to pay a fine on them, so it would be better if you people take care of this and avoid the fine by paying on time.

Be aware of policy expiry and coverage details

Expiration of policy means that your insurance has expired and you can no longer get coverage. After the expiry of the policy, you will have to bear all your medical expenses yourself and the company will not be responsible for your health. Therefore, it would be better for you to continue your health insurance.

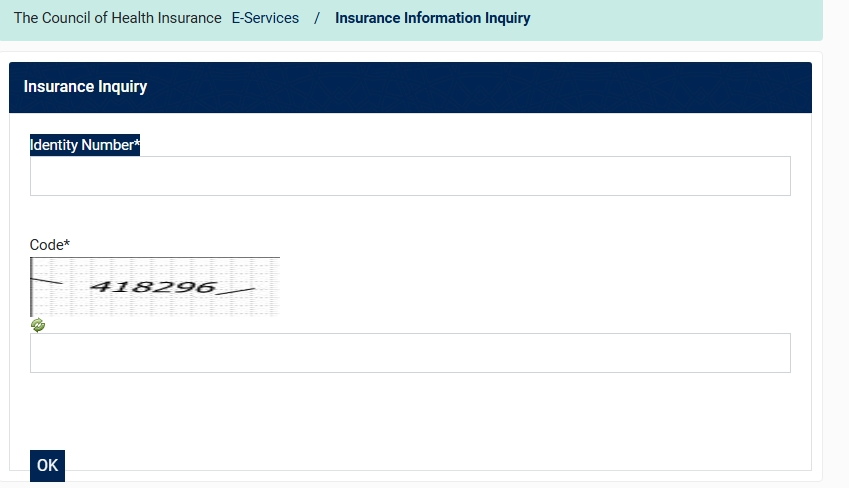

Below is some information to check medical insurance status through CCHI (Cooperative Health Insurance Council).

First of all, you have to go to the official website of cchi, there you have to go to check your health insurance status and give your identity number, after that a code has been given below and you have to check your insurance.